Let’s be real, not everyone starts with a fat bank account. But guess what? That’s no excuse to miss out on the investment game. Even with a small income, you can still grow your money and achieve your financial goals.

Start Small, Dream Big:

You don’t need to be Dangote or Otedola to start investing. Even with N100 or N200, you can begin your investment journey. The key is consistency. Imagine planting a small seed; with care, it grows into a big tree. That’s how investing works.

Know Your Why:

Before you dive in, figure out your money goals. Is it to buy a car, own a house, or just have a financial cushion? Knowing your ‘why’ helps you choose the right investments.

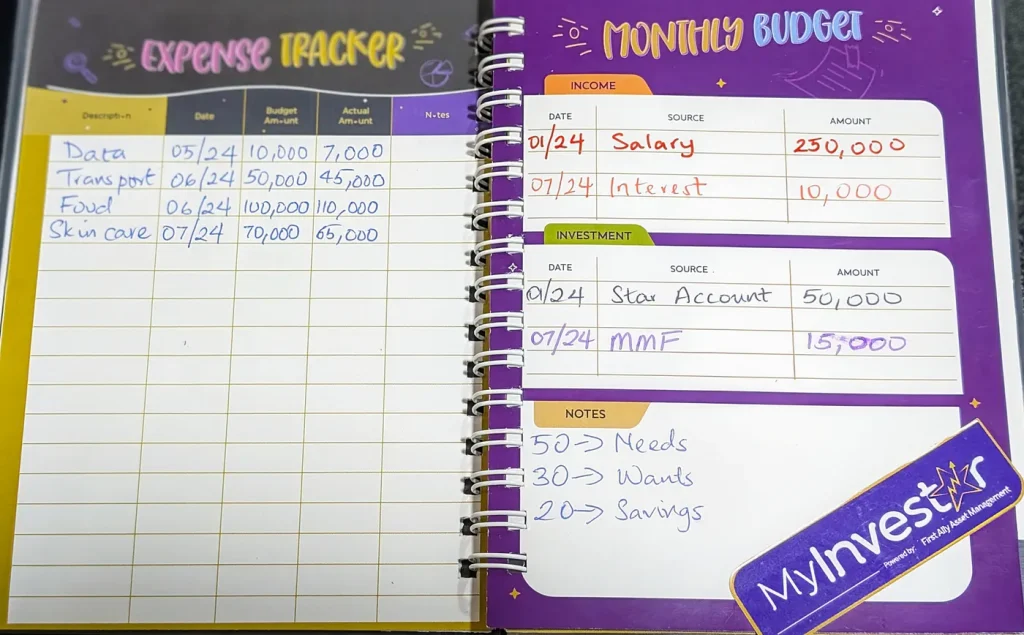

Leverage MyInvestar:

MyInvestar is your plug for low-income investing. Our Star Account is perfect for starters. You can save and invest at the same time. We also have the Goal Account to help you reach specific targets like that dream vacation or owambe.

Automate Your Hustle:

Set up automatic transfers from your account to your investment account. This way, you’re investing without even thinking about it. It’s like saving effortlessly!

Educate Yourself:

Knowledge is power. Follow financial blogs, listen to podcasts, and read books. MyInvestar also has resources to help you learn. The more you know, the better your investment decisions.

Patience is Key:

Investing is a long-term game. Don’t expect to become rich overnight. Stay consistent, and your money will grow over time.

Remember, every journey starts with a single step. Even with a small income, you can build a strong financial future with MyInvestar. Let’s make it happen.