Ever wondered why some people are glued to stock charts like it’s the latest football match, while others buy shares and basically forget about them? Truth is, both trading and investing can grow your money, but they work in very different ways. Picking the right one for you can save you stress, time, and maybe even a few grey hairs.

If you’re thinking about how to make your money work harder in Nigeria, this guide is for you. Let’s break it down.

What Is Trading?

Trading is basically buying and selling assets like stocks, forex, or commodities frequently to take advantage of short-term price movements. The goal? Quick wins.

Think of trading like your favourite Naija reality TV show: it’s fast, it’s intense, and you need to make moves at the right time. Traders follow charts, news, and market trends like pros, making decisions in minutes, days, or weeks.

Quick Breakdown:

- Timeframe: Short-term

- Goal: Profit from price changes fast

- Tools: Charts, market trends, news updates

- Example: Buy a stock on Monday, sell on Friday after it jumps 5%

What Is Investing?

Investing is all about putting your money into assets like stocks, bonds, or funds and letting it grow over time. Instead of chasing fast wins, investors in Nigeria focus on long-term growth.

Think of investing as planting a tree. You water it, give it sunlight, and watch it grow. Over time, it bears fruit (or in this case, money!).

Quick Breakdown:

- Timeframe: Long-term (years or even decades)

- Goal: Grow wealth steadily through dividends and capital gains

- Tools: Company fundamentals, economic trends

- Example: Buy shares in a solid Nigerian company and hold them for 10+ years while it grows and pays dividends

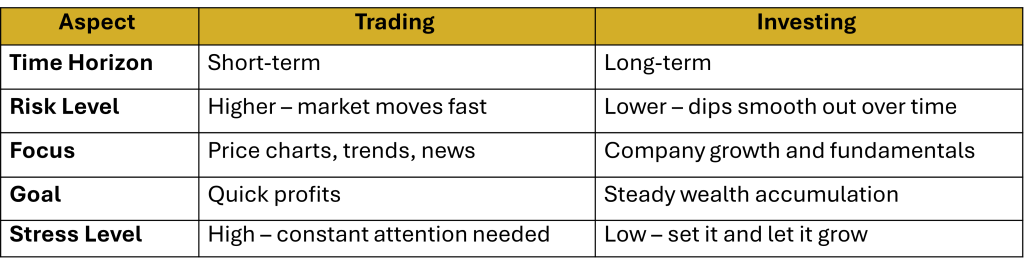

Trading vs Investing: Quick Comparison

Which One Should You Pick?

It really comes down to your style, lifestyle, and money goals:

- Love quick decisions, market alerts, and can handle risk? Trading might be your vibe.

- Prefer patience, stability, and watching your money grow over time? Investing is your best friend.

Spoiler: You don’t have to choose forever, you can start small, experiment, and figure out what works for you.

How MyInvestar Helps You Build Wealth in Nigeria

No matter your style or goals, MyInvestar gives young Nigerians the tools to manage their money smartly and grow their wealth over time. Whether you’re saving for something special, planning for the future, or just looking to get better at managing your finances, you can do it all in one place.

From tracking your savings to setting goals and keeping an eye on your progress, MyInvestar makes managing your money simple, fun, and stress-free. It’s all about helping you take control, make smarter decisions, and build the financial future you want.

Download the MyInvestar app here, available on Google Play Store and App Store.

With MyInvestar, you can create a portfolio that matches your lifestyle, risk level, and goals, not someone else’s. Start small, stay consistent, and let your money work for you.

Final Thought

Trading and investing are just two different ways to build wealth in Nigeria. The trick is knowing which fits your personality and financial goals. And if you’re unsure, start small, try both, and use MyInvestar as your guide. Your journey to smart savings, investments, and financial freedom starts today.